JLR, financing services for sustainable mobility

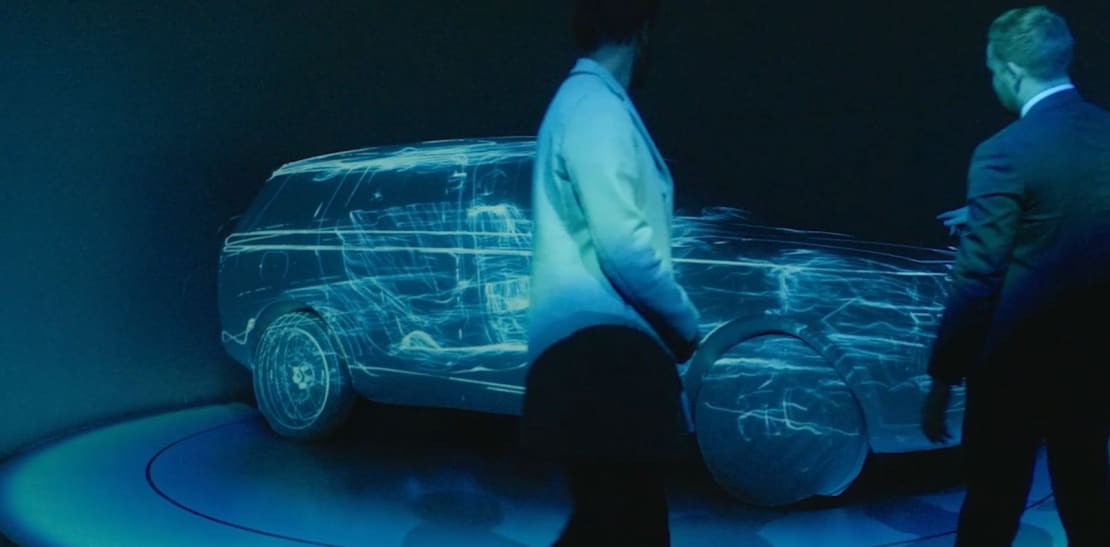

With electric vehicles set to go mainstream and cars beginning to be used in different ways as mobility increasingly becomes a service, JLR is positioning itself for the transition by integrating new technology into its vehicles to create a modern luxury experience.

In January 2023, the luxury British car maker’s long-term strategic partnership with BNP Paribas went live. Providing mobility financing and services across nine European countries – including France, Germany, Italy and Spain – the collaboration comes as the global shift towards digitalisation creates exciting opportunities for a host of new services through software-defined vehicles.

At the same time, changes are being driven by the rise of a “usership” (or rental) model in preference to ownership, especially among younger consumers. Furthermore, with electrification central to JLR’s goal to reach carbon net zero across its supply chain, products, and operations by 2039, the company plans to launch pure electric models in each of its brands by 2030.

For those who move the world: JLR and BNP Paribas

JLR and BNP Paribas have launched a range of new mobility financing services in 9 European markets. The British carmaker is innovating and developing an integrated offering covering all aspects of financing to provide a customer experience that is better adapted to the mobility of today and tomorrow.

Meeting the challenges of the new world of mobility

“To meet the challenges of electrification and the new world of mobility, we need a strong corporate banking partner,” says Chris Kent, JLR’s Director of Global Financial Services, adding that trust with BNP Paribas has been built up over many years.

Despite this existing strong relationship, JLR launched a competitive tender with a range of European banks. BNP Paribas’s superior offer enabled it to win, allowing it to deliver the complete integration of its services with JLR’s tools, to the point where they become invisible.

It took a year of preparation and negotiation, with around 40 people from both companies working with what Chris describes as “a true joint venture spirit”. “Ultimately, it comes down to that degree of confidence that you have with the people that you're working with, that they understand where you're trying to take your business, and they're going to be there to support you. That was what set BNP Paribas apart in the tender process,” adds Chris.

“We started with a double ambition. First was to accompany JLR in its transformation,” explains Paul Milcent, Global Head of Mobility Business Line at BNP Paribas, pointing to the high level of investment in order to accompany the technology shift, especially changes to its manufacturing infrastructure. To this end, BNP Paribas CIB is assisting JLR in financing the substantial capital expenditure required to remodel existing factories.

“Second was to reinvent the customer experience [with] services which are extremely flexible and completely embedded in the JLR experience,” says Milcent, pointing out the need to adapt to customers’ changing expectations and behaviour which are transforming the way cars are being distributed and used.

Through its One Bank service, BNP Paribas provides a one-stop-shop for all aspects of JLR’s transformation, with tailored financial services for wholesale and retail clients. Retail financing solutions include traditional loans, lease-to-purchase, and long-term leases, while Arval delivers lease and fleet management and BNP Paribas Cardif offers insurance products.

A seamless digital journey from website to showroom

BNP Paribas’s services are designed to enable customers to access products smoothly, including the ability to opt in and out of vehicles as required, with solutions for reselling or recycling EVs. But it is not only about the EVs themselves: it also means financing the ecosystem around mobility, such as chargers, or the ability to make in-car payments. “This means that the relationship with the customers is going to be much more frequent than it used to be,” adds Milcent.

Frédéric Drouin, JLR’s Managing Director for Financial Services Europe, underlines that one of the key objectives of the integrated platform is to save time for the client and facilitate sales. “BNP Paribas and JLR have been partnering to create a seamless digital journey, from websites to the retailer’s showroom,” says Drouin, explaining that in the future all the screens will be connected, from desktop computers to smartphones and even vehicle dashboards. “This is a huge IT transformation that we are doing together with BNP Paribas,” he adds.

JLR is positioning itself for the transition by integrating new technology into its vehicles to create a modern luxury experience.