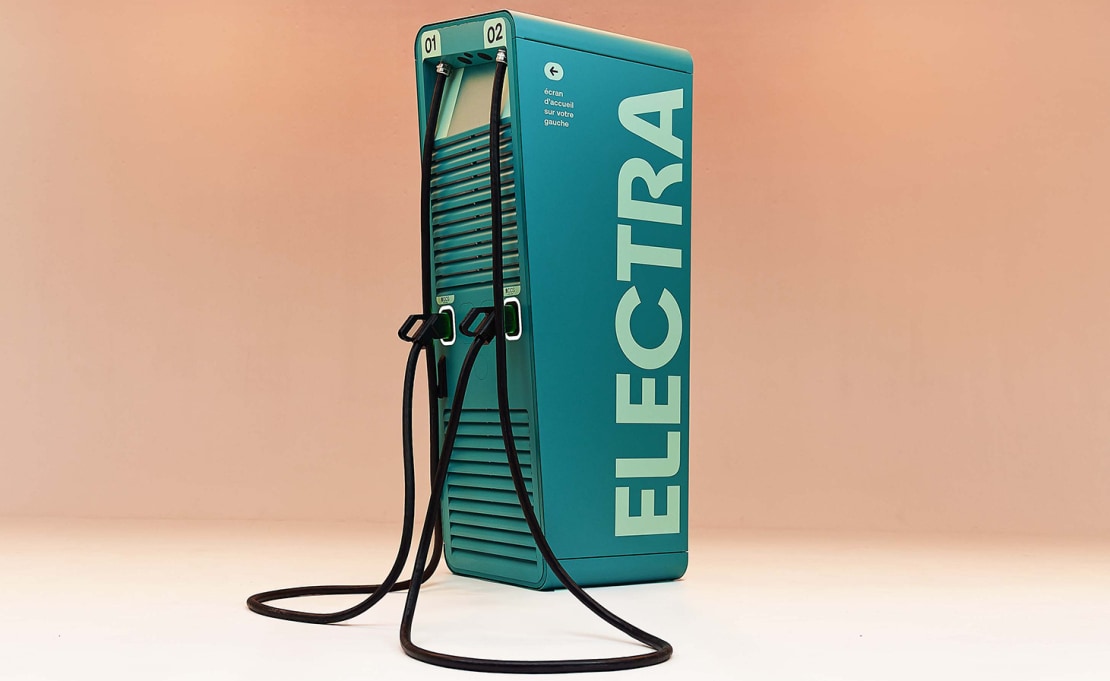

Electra, an optimised recharging experience

Founded in France early in 2021, Electra is leading the way in the energy transition by decarbonizing mobility and democratizing EVs. It is doing so by rapidly rolling out a network of ultra-fast charging stations, which are already spread across nine European countries, including France, Germany, Italy and Spain. The French scale-up also offers one of the fastest charging speeds on the market: it takes just 15 to 20 minutes.

As a highly capital-intensive business, Electra relies on its partnership with BNP Paribas to support its growth in this fiercely competitive market through financing, guarantees, and day-to-day operational support.

“Electra is an infrastructure business. In our industry, capital is paramount,” says Aurelien de Meaux, co-founder and CEO of Electra, who is keenly aware that adequate charging infrastructure is a prerequisite for the energy transition to be successful, and EVs to go mainstream. He aims for Electra to control a network of more than 2200 charging points around Europe by 2030 – but with every site costing around half a million euros, that will require an infrastructure investment of more than €1bn.

For those who move the world: Electra and BNP Paribas

Electra offers one of the fastest charging systems for electric vehicles on the market. A 100% digital customer journey, ultra-fast recharging speed, reservable charging points in 9 European countries...

With a business model based on traditional service stations, Electra rents spaces in locations like public car parks, shopping centers, restaurants, supermarkets, transport hubs and hotels, mainly in sites in urban peripheries that are close to road junctions, motorway exits or logistics centers. However, Electra owns the charging points: ultimately it is a charging point operator, selling electricity to drivers, individuals and professionals.

Although there has been stiff competition for the best locations as the energy transition has taken root over the last three years, Electra’s special focus on customer experience has caught the attention of major stakeholders and investors. Electra sets itself apart from competitors through technological innovation: its “turnkey”, developed entirely in-house, notably provides a 100% digital customer journey, including an app that allows users to book a charge point, monitor charging in real time, and pay.

Electra rolls out a network of ultra-fast charging stations, which are already spread across nine European countries.

The need for a partner to support growth

Elise Erbs, CFO at Electra, explains that the fast-growing company needed a banking partner to support its growth in multiple ways. “BNP Paribas had the reputation of helping new businesses to grow... What is really comfortable with BNP Paribas is the reactivity. We need answers very quickly. We need certain services, and we really found them with BNP Paribas. The Green Desk specifically is really adapted to our business, and in particular our constraints, our markets.”

The Green Desk of BNP Paribas' commercial banking in France, which is dedicated to energy transition pure players, provides Electra with a range of services, including cash management, corporate financing, fundraising advisory and guarantees. With its help, and BNP Paribas CIB acting as Financial Advisor, Electra raised €304 million in equity in January, doubling what it has raised in the last three years.

“This level of funding is really taking us to the next stage. It's giving us the financial means for our ambition. It was key for us to have BNP Paribas as advisors helping us ensure that the whole process was conducted thoroughly,” says de Meaux.

This level of funding is really taking us to the next stage. It was key for us to have BNP Paribas as advisors helping us ensure that the whole process was conducted thoroughly.

Clémence Monteyremard, Senior Relationship Manager at BNP Paribas’s Green Desk, describes the fundraising for Electra as “a game changer for this industry and for innovative companies” in general – not least because it was the largest fundraising of its kind in France and the second largest in Europe.

She adds: “It requires proximity, trust, and reactivity from the Green Desk, and financial expertise to understand Electra’s business model… We provide advice to facilitate scaling up and to empower their vision. The fast-charging market is still in its early stages, with substantial funding needs.”

Providing guarantees to move projects forward

One of the most important services provided by BNP Paribas is providing guarantees that notably enable Electra to win public tenders to install charging stations in the best locations – so they are fundamental for growth. Since the EV business is a long-term game, hefty guarantees are needed to cover rent often for periods of 15 years.

“One of our biggest challenges is that we need to find the best locations, and money, at the same time. But you need money for the locations, and locations for the money... it's like the chicken and the egg,” says Erbs, who points out competition from established and well-funded companies, and building up credibility and trust as other major challenges. “So it's important to us to have BNP Paribas alongside us for our main projects like these guarantees,” she adds.

Electra provides a 100% digital customer journey, including an app that allows users to book a charge point, monitor charging in real time, and pay.