28.2

€bn

2022

38.3

€bn

2025

40

€bn

2030 Target

- 28.2 €bn | 2022

- 38.3 €bn | 2025

- >40 €bn | 2030 Target

Learn more

Learn more

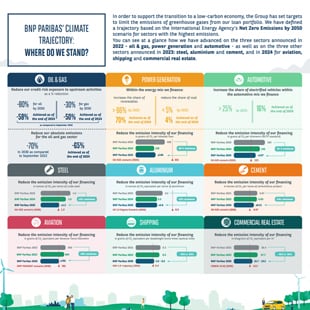

Amount of financing (credit exposure) allocated to low-carbon energies, and essentially renewable sources, at the end of September 2025. This includes hydroelectric, solar, wind, and, to a lesser extent for BNP Paribas, nuclear, all of which emit no greenhouse gases and are therefore low-carbon. The Group aims to ensure that they account for 80% of its financing for energy generation by 2028 and 90% by 2030.

Amount of financing (credit exposure) allocated to low-carbon energies -in 2022: 28.2 billion euros -in 2025: 38.3 billion euros The target in 2030 is more than 40 billion euros