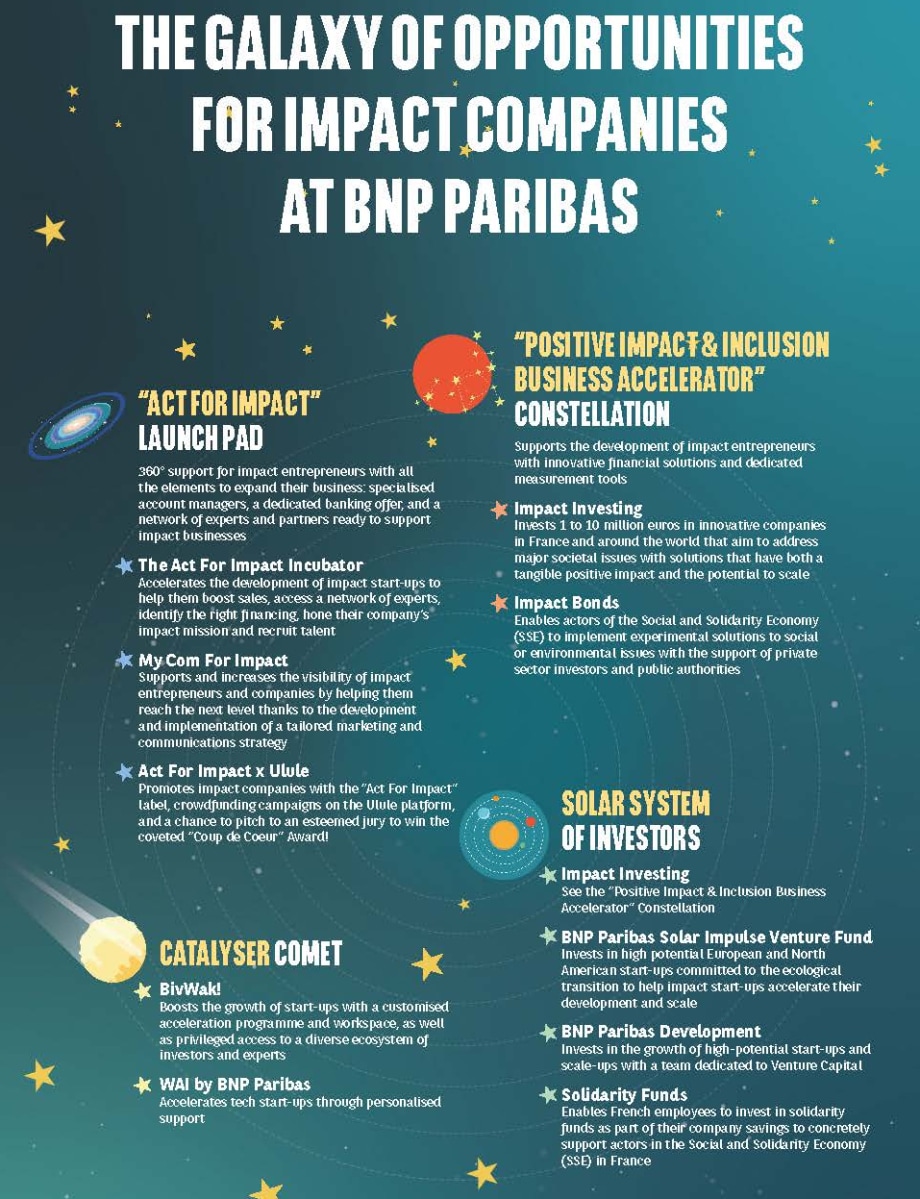

The Galaxy of Opportunities for Impact Businesses at BNP Paribas

The Galaxy of Opportunities for Impact Businesses at BNP Paribas

The "Act For Impact” Launch Pad

BNP Paribas’ Act For Impact programme supports entrepreneurs and companies committed to having a positive social or environmental impact. This programme includes 200 dedicated BNP Paribas account managers who work with the Group’s partners (networks, incubators, investment funds) to provide tailored solutions for every business type. Act For Impact is both a banking offer and a community that unites all stakeholders – traditional companies, individuals, local authorities, experts – involved in helping to support impact companies.

-

BNP Paribas’ Act For Impact incubator aims to accelerate the development of early-stage impact start-ups. It offers privileged access to the Group’s network of experts and community of entrepreneurs from the BivwAk!, EDHEC and Station F.

-

Created by BNP Paribas Commercial & Personal Banking in France and Publicis in 2021, the annual "My Com For Impact" competition is a programme that helps impact entrepreneurs define and implement a tailored marketing and communications strategy to build their brand and scale their business. My Com For Impact has already supported 15 winners over 3 years, providing them with services valued at more than 3 million euros.

-

BNP Paribas launched the Act For Impact label in 2014 to promote impact businesses and help them increase their visibility. Each quarter, the crowdfunding platform Ulule pre-selects Act For Impact projects, giving them the chance to pitch to an esteemed jury. The prize? 2,000 euros in support for each of the 5 winners selected by the jury or the public and employee vote, and an additional 2,000 euros for the winner of the “Coup de Coeur” prize.

The “Positive Impact & Inclusion Business Accelerator” Constellation

The Positive Impact & Inclusion Business Accelerator (PIIBA) aims to support impact entrepreneurs by developing innovative financial solutions (including impact bonds), acquiring direct equity stakes in impact companies, offering companies an impact measurement tool, and providing social and financial services.

-

The Group’s impact investing team helps companies in Europe and around the world that address major social and environmental challenges scale and grow their businesses. They invest between one million euros and 10 million euros (with an average investment of 4 million euros) in companies, favouring Series A and equity financing. Investing directly in companies from the Group's own account allows for greater flexibility in their approach, both in terms of investment timelines and involvement. The team supports impact companies over the long-term, providing them access to expertise from across the Group. BNP Paribas' impact investing team is an internal joint venture between PIIBA and BNP Paribas Asset Management.

-

Impact bonds allow actors in the Social and Solidarity Economy (SSE) to deploy experimental programmes in response to social or environmental issues without taking on any financial risk thanks to the involvement of private investors and public actors. The concept is simple: These experimental programmes are pre-financed by investors, who will be reimbursed in full or in part by public authorities such as the State depending on the achievement of the impact objectives set forth at the start and objectively assessed by an independent evaluator.

Catalyser Comet

-

The BivwAk! is a bridge, with an international reach, that leverages existing collaborations and investments with start-ups to foster innovation at scale. The BivwAk!’s start-up acceleration and hosting services include: B! UP Explore for early-stage French start-ups; B! UP Accelerate for mature and international start-ups; and B! UP Impact, for positive-impact start-ups.

-

The WAI (“We Are Innovation”) by BNP Paribas is a programme dedicated to innovative start-ups and companies. BNP Paribas offers specialised financing solutions that includes tailor-made support with a network of 100 expert bankers and more than 50 partner venture capital investment funds. The WAI by BNP Paribas also promotes collaboration between start-ups and corporates thanks to its strategic partnerships and privileged access to the Group’s resources.

Solar System of Investors

-

The BNP Paribas Solar Impulse Venture Fund (BNPP SIVF) – an exclusive partnership between Bertrand Piccard's Solar Impulse Foundation and BNP Paribas Asset Management –completed its final closing in January 2025, raising 172 million euros to invest in European and North American high-potential growth startups committed to the ecological transition to help them scale and increase their impact. This fund tackles the challenges of the ecological transition in a broad sense, targeting sectors such as the energy transition, sustainable agriculture and food,the circular economy, biodiversity, smart cities, sustainable mobility, and industrial innovation.

-

Thanks to its Venture Capital activity and dedicated Venture team, BNP Paribas Développement invests the Group’s own funds in the development and growth of high-potential start-ups and scale-ups with an “Evergreen” approach to investing in these companies over the long-term. This includes Healthtech (Medtech and digital health), Deeptech, the ecological transition, tech, cybersecurity, and AI.

-

See the Positive Impact & Inclusion Business Accelerator Constellation above.

-

A specificity of France, the solidarity funds managed by BNP Paribas Asset Management and distributed by BNP Paribas Epargne & Retraite Entreprises enable employees in France to concretely support the development of Social and Solidarity Economy (SSE) players through their company savings plans. For example, this includes SSE actors that support entrepreneurship, as well as projects related to social housing and job creation for vulnerable populations.