The Board of Directors of BNP Paribas met on 29 April 2015. The meeting was chaired by Jean Lemierre and the Board examined the Group’s results for the first quarter 2015.

STRONG INCOME GROWTH DESPITE THE IMPACT OF THE FIRST CONTRIBUTION TO THE SINGLE RESOLUTION FUND

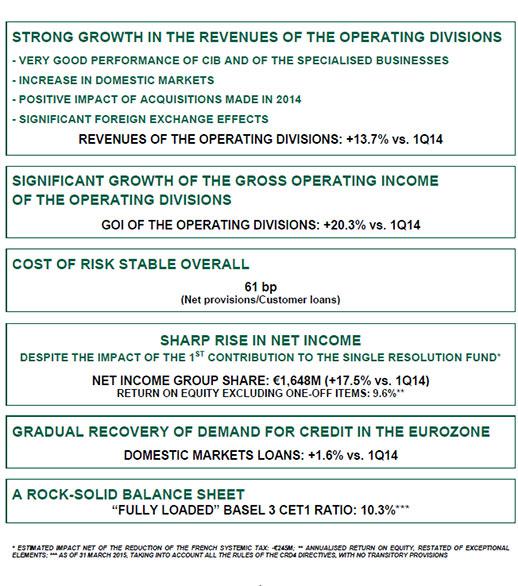

The Group posted a good overall performance this quarter thanks to the good sales and marketing drive and the strong growth of its operating divisions. In the Eurozone, demand for credit is gradually recovering in a context of economic growth picking up. In America and in Asia, the Group enjoyed good business development.

Revenues totalled 11,065 million euros, up 11.6% compared to the first quarter 2014. They included this quarter the impact of an exceptional +37 million euro Own Credit Adjustment (OCA) and own credit risk included in derivatives (DVA). The one-off revenue items for the first quarter 2014 totalled 237 million euros.

The revenues of the operating divisions were up sharply due in particular to the very good performance of CIB and of the specialised businesses, the positive impact of acquisitions made in 2014 and favourable foreign exchange effects. The revenues of the operating divisions thus rose by 13.7% compared to the first quarter 2014: +2.3% for Domestic Markets1, +20.3% at International Financial Services and +23.7% for CIB.

Operating expenses, at 7,808 million euros, were up by 14.9%. They included the one-off impact of Simple & Efficient transformation costs and the restructuring costs of the acquisitions made in 2014 which totalled 130 million euros (142 million euros in the first quarter 2014). They also included a 245 million euro impact (2) for the first contribution to the Single Resolution Fund whose entire contribution for 2015 was fully booked this quarter based on the IFRIC 21 “Levies” interpretation.

The operating expenses of the operating divisions were up by 10.7%, resulting in a largely positive jaws effect (3 points). They were up 1.1% in Domestic Markets1, 20.6% in International Financial Services and 13.4% in CIB.

Gross operating income was up by 4.5%, at 3,257 million euros. It increased by 20.3% for the operating divisions.

The Group’s cost of risk was down by 3.7%, at 1,044 million euros (61 basis points of outstanding customer loans). It included a one-off 100 million euro provision due to the exceptional situation in Eastern Europe in the first quarter 2014. It was on the whole stable excluding this effect.

Non operating items totalled 339 million euros. They included in particular this year a 94 million capital gain (3) on the sale of a non-strategic stake and a 67 million euro capital gain due to the merger between Klépierre and Corio. Non operating items totalled 96 million euros in the first

quarter 2014.

Pre-tax income was thus up 19.8% compared to the first quarter 2014, at 2,552 million euros. For its part, the pre-tax income of the operating divisions was up by 38.6%.

The Group generated 1,648 million euros in net income attributable to equity holders (1,403 million euros in the first quarter 2014), up by 17.5% compared to the same period a year earlier (+38.7% excluding one-off items and the impact2 of the first contribution to the Single Resolution Fund). Return on equity, excluding one-off items but including the impact of the first contribution to the Single Resolution Fund, was 9.6%.

The Group’s balance sheet is rock-solid. As at 31 March 2015, the fully loaded Basel 3 common equity Tier 1 ratio(4) was 10.3%. The fully loaded Basel 3 leverage ratio (5) came to 3.4% (6).The Group’s immediately available liquidity reserve was 301 billion euros (291 billion euros as at 31 December 2014), equivalent to over one year of room to manoeuvre in terms of wholesale funding.

The net book value per share was 70.2 euros, representing a compounded annualised growth rate of 7.1% since 31st December 2008.

Lastly, the Group is actively implementing the remediation plan agreed as part of the comprehensive settlement with the U.S. authorities and is continuing to reinforce its internal control and compliance system.

(1) Including 100% of Private Banking in Domestic Markets (excluding PEL/CEL effects)

(2) Estimated impact, net of the reduction of the French systemic tax

(3) CIB-Corporate Banking (€74m), Corporate Centre (€20m)

(4) Taking into account all the rules of the CRD4 directives with no transitory provisions

(5) Taking into account all the rules of the CRD4 directives with no transitory provisions, calculated according to the

delegated act of the European Commission dated 10 October 2014

(6) Including the forthcoming replacement of Tier 1 instruments that have become ineligible with equivalent eligible

instruments