BNP Paribas is now listed in the Dow Jones Sustainability Indices* World and Europe

In 2021, only 24 banks out of 168 assessed found their way into the World index, and only 9 banks out of 34 in the Europe index.

Major improvements for the Group between 2020 et 2021 took place in the areas of “Policy influence” (+40 points), “Operational Eco-Efficiency” (+14 points), “Tax Strategy” (+12 points), “Cybersecurity” and “Labor Practice Indicators” (+10 points).

This year, and for the first time since the Group first participated in the assessment, BNP Paribas has positioned itself in the top 10 % of the banking sector across all three CSA dimensions : top 9 % for “Governance & Economic”, top 1 % for “Environment” and top 4 % for “Social”, asserting its leadership in extra-financial performance.

In Particular, BNP Paribas received the distinction of 100/100 scores in topics such as “Materiality“ (a strategy aligned with the most material sustainability for its activities and its stakeholders), “Environmental Reporting”, “Social Reporting” and “Financial Inclusion”.

SAM & BNP Paribas

Founded in 1999 by the Swiss asset manager Robeco (formerly RobecoSAM) and purchased in November 2019 by the American credit rating agency S&P Global, the SAM rating is considered to be the most advanced worldwide in terms of sustainability, covering over 10.000 companies from all sectors. The rating relies on a detailed extra-financial questionnaire: the S&P Global Corporate Sustainability Assessment (CSA). Depending on scores attributed based on an annual rating, eligible issuers are then listed or not within the Dow Jones Sustainability Indices.

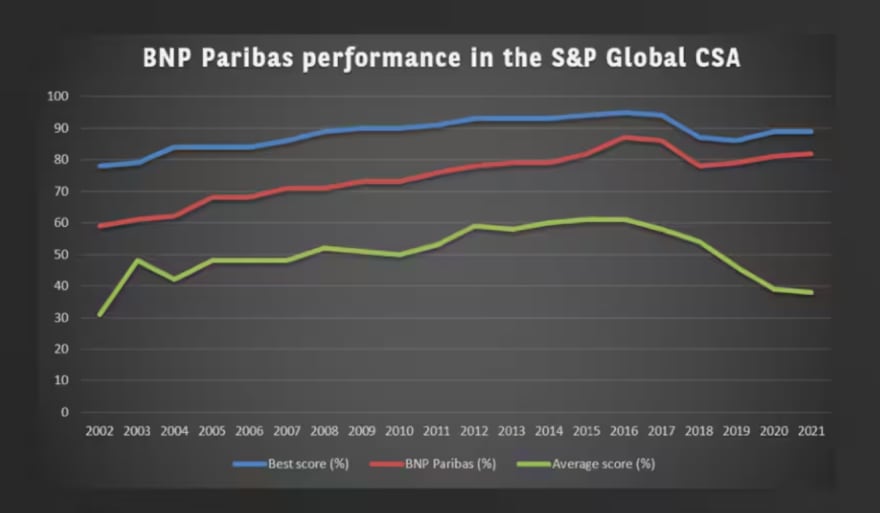

Since 2002, BNP Paribas has participated in this prestigious rating through performing its CSA evaluation. Structured on three domains, this questionnaire assesses activities and policies in the fields of economic responsibility (corporate governance, protection of clients’ interests, business ethics…), environmental responsibility (climate reporting, management of climate-related risks…), and social responsibility (health and safety, talent attraction, philanthropy…). The SAM rating always relies on a questionnaire specific to the companies' industry.

By maintaining itself within the highly selective World and Europe Dow Jones Sustainability Indices, BNP Paribas demonstrates once again its position as a sectoral leader in terms of extra-financial performance. This year, BNP Paribas succeeded in improving both its absolute score (82/100, +1 point when compared to 2020) and relative ranking (top 6 % of the banking industry). I therefore would like to express my sincere thanks to all the contributors and experts that enabled the Group to secure this outstanding recognition.

Extra-financial ratings

Extra-financial analysis consists in assessing companies, sovereign states, and other kinds of issuers of financial securities on their environmental, social and governance (ESG) policies. Based on this analysis, the agency then draws up a rating that enables a comparison to be made between different issuers – whether or not they are listed companies – on their ESG practices.

BNP Paribas' recent scores

cdp (2020)

ecovadis(2021)

msci esg rating(2020)

Recent scores with a presence in related indices

FSTE4GOOD (2020)

FSTE4GOOD Global index

solicited rating: A1+

V.E. (former vigeo eiris)indices : euronext-vigeo eiris world 120, eurozone 120, europe 120 et France 20

- BNP Paribas was designated World's Best Bank for Sustainable Finance in Euromoney’s Awards for Excellence 2021, a reference publication in international finance;

- BNP Paribas ranks 1st French bank and 4th international bank in the 2021 “Global 100 Most Sustainable Corporations” ranking established by the specialized Canadian magazine Corporate Knights ;

- In 2021, BNP Paribas’ shares have been listed in Bloomberg Gender-Equality Index.