This result enables the Group to retain its position as first bank in the sector of “Diversified Banks” in Europe (out of a universe of 31 companies) and to be ranked in the global top 2% (across all sectors and regions) of companies rated by the agency at that date.

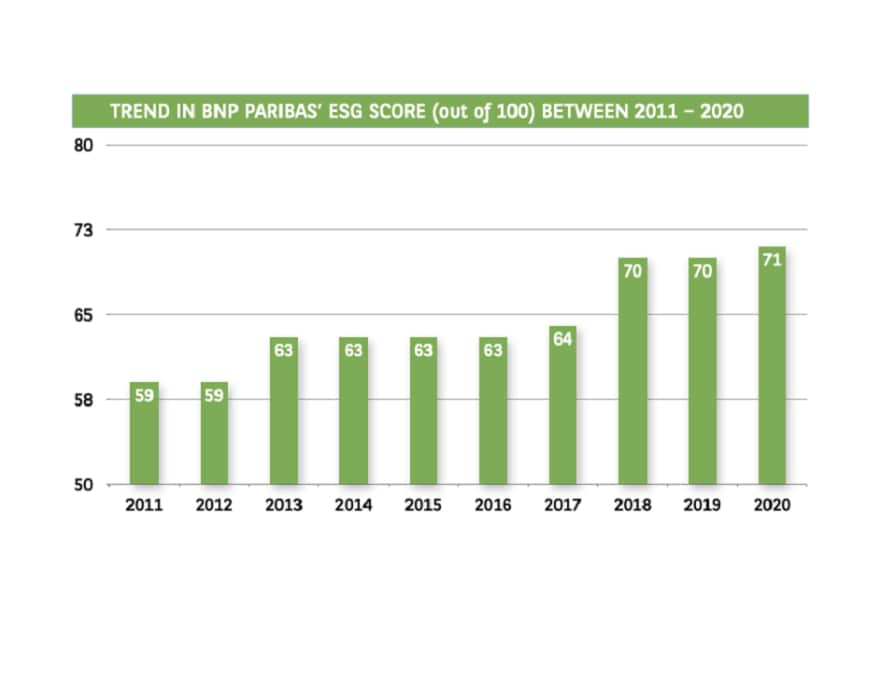

Moreover, with a score of 71/100 obtained in respect of its biannual ESG (Environmental, Social and Governance) rating, in January 2021, BNP Paribas has achieved its best performance since the Group began taking part in this exercise in 2003. BNP Paribas is therefore ranked as the leader in its sector (Diversified Banks) and 9th best-rated company by the agency, across all sectors and regions (out of a total universe of more than 4,900 companies as at 04/01/2021).

ESG score evolution

These excellent results enable BNP Paribas to remain in the Euronext-Vigeo Eiris ethical indices: World 120, Eurozone 120, Europe 120 and France 20.

V.E solicited rating methodology

The solicited rating is established by V.E in two stages:

It is based firstly on an assessment of BNP Paribas’ environmental, social and governance (ESG) performance, which takes place every two years and is not solicited by the issuer.

Subsequently, the assessment of the Group's ESG performance is supplemented by a qualitative review of the key CSR issues facing the Group. This is done through high-level meetings with key players in BNP Paribas’ governance with regard to the management of ESG risks, which are classified into four categories:

- “Reputation”

- “Operational Efficiency”,

- “Human Capital”

- “Legal Security”.

Accordingly, the rating attributed to BNP Paribas by V.E in respect of the solicited rating breaks down into three key components:

- A letter (A, B, C or D), positioning the company in one of the four performance quartiles of V.E’s global universe;

- A figure (1, 2 or 3), positioning the company in relation to its peers (“Diversified Banks in Europe” in BNP Paribas’ case) situated in the same quartile;

- A symbol (“+” or “-”), positioning the company in relation to its peers (“Diversified Banks in Europe” in BNP Paribas’ case) at the level of each theme of its ESG rating;

The solicited rating established by V.E therefore constitutes a major qualitative complement to BNP Paribas’ biannual ESG assessment: in addition to updating the data provided for the latter, it specifically addresses the environmental, social and governance issues faced by the Group over the last few months, such as the consequences of COVID-19 or the announcement of a timetable for complete withdrawal from thermal coal (for 2020 solicited rating). This enables the Group to precisely and comprehensively meet the needs of shareholders with responsible investment strategy.

Management of major ESG issues recognised by V.E

This year, V.E commended in particular BNP Paribas’ management of issues specific to human capital, the incorporation of ESG issues in financing and investment activities, and the application by the Board of Directors of best governance practices.

This excellent performance is reflected in the scores of 90/100 and above obtained by the Group in the themes “Non-Discrimination & Diversity”, “Board of Directors” and “Shareholders”.

Moreover, the Group has seen significant progress in its performance in relation to 2019 in all of the four categories defined by V.E:

+13 points on the criterion “Societal impacts of the company’s products / services” and +9 points on the criterion “Executive remuneration”, in the Reputation category;

+10 points on the criterion “Transparency & Integrity of influence strategies and practices”, in the Operational Efficiency category;

+8 points on the criterion “Career management & Promotion of employability”, in the Human Capital category;

+9 points on the criterion “Responsible customer relations”, in the Legal Security category.

BNP Paribas’ results in its 2020 solicited rating confirm its leadership position in terms of non-financial performance in the banking sector. They recognise the efforts implemented across the Group to incorporate the best environmental, social and governance principles in the conduct of business and corporate culture. This A1+ rating is the result of a robust CSR strategy that BNP Paribas has successfully implemented over the long term, while demonstrating its ability to respond to the rise of new challenges such as the ongoing health crisis. In this context as in any other, we will continue to support our customers in their development while applying the best ethical standards to our activities

V.E and BNP Paribas

Born of the merger between two European leaders in the assessment of the environmental, social and governance performance of companies and organisations, V.E (formerly Vigeo Eiris) is a global player in extra-financial analysis. Moody’s Investor Services became majority shareholder of V.E in April 2019.

BNP Paribas has participated in V.E’s unsolicited rating since 2003, responding to a questionnaire on its activities and its environmental, social and governance (ESG) policies. Since 2019, BNP Paribas’ non-financial performance is also assessed through V.E’s proprietary solicited rating service.

For more informations