A first of its kind framework for nature-related risk management and disclosures

The planet’s biodiversity is currently declining faster than at any other time in human history, representing major risks for the environment, sustainable development and global supply chains. The Beta Release of the TNFD’s framework is the first to offer a framework for corporates and financial institutions to integrate these concerns into their decision-making and disclosures through nature-related risk and opportunity analysis.

The current framework is based on three components:

Key science-based concepts and definitions so that market participants can better understand the risks and opportunities related to nature;

Recommendations for disclosures that are in-line with work carried out by the Taskforce on Climate-Related Financial Disclosures (TCFD), which acknowledges the interlinkages between the two subjects and the need for a consistent approach to sustainability reporting;

Practical guidance for companies and financial institutions looking to analyze nature-related risks and opportunities and for integrating them into their processes.

Open innovation to accelerate nature positive impacts

Members of the TNFD, which includes BNP Paribas’ Sébastien Soleille, Global Head of Energy Transition, and Deputy member Robert-Alexandre Poujade, ESG Analyst BNP Paribas Asset Management, are looking to improve the framework’s relevance, usability and effectiveness.

This work will be carried out mainly through consultations and collaborations with a wide variety of market players and stakeholders who will offer their feedback through an open innovation approach. All organisations wanting to participate will now be able to test the beta version and give feedback on how relevant it is, its usage, its implementation, and more.

The beta framework has been designed by the TNFD to be complementary to the TCFD report, which BNP Paribas releases annually, to address future global standards in sustainability (like the International Sustainability Standards Board). The framework also takes local specificities tied to biodiversity into account, notably the importance of the geographical location of impacts.

“BNP Paribas has been very active in TNFD’s launch and ongoing work because we consider that this collective action is very important to contribute to the development of a relevant common framework to improve biodiversity-related risk management and disclosure.”

Sébastien Soleille is on Linkedin!

See and share Sébastien Soleille's post on the TNFD on LinkedIn

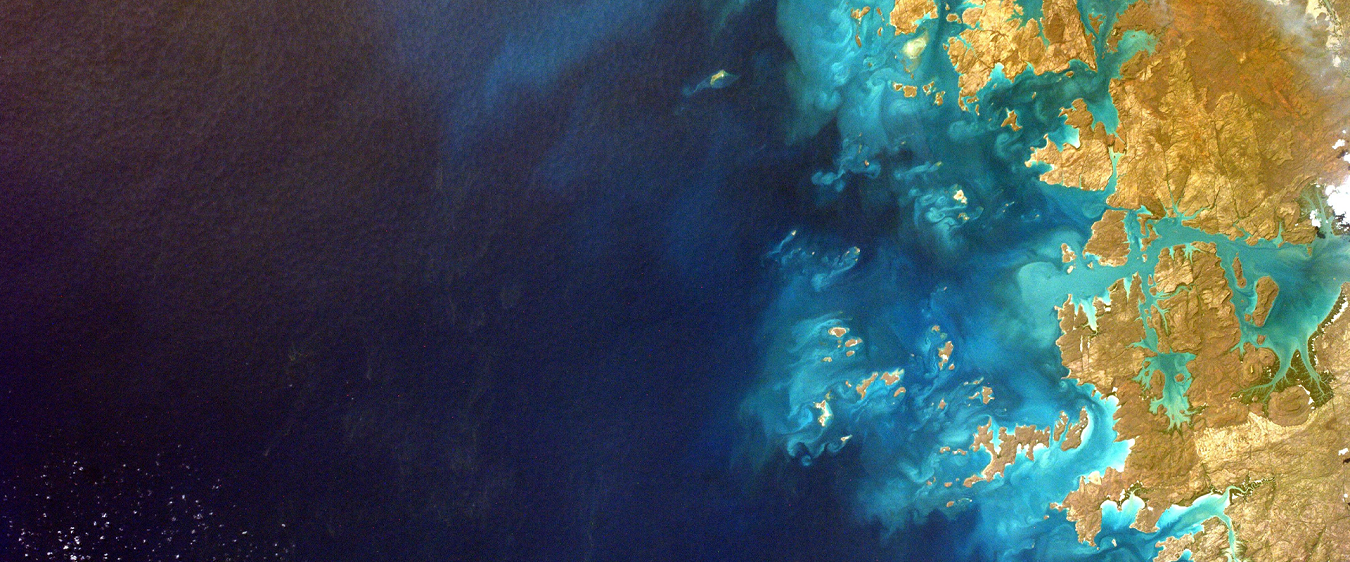

Photo credit: NASA / Unsplash