Read the BNP Paribas 2022 Climate Report

Like last year, this exercise in transparency is carried out following the recommendations of the Task Force for Climate-related Financial Disclosures (TCFD), a working group set up in 2015 by the G20 Financial Stability Board to improve climate related financial reporting. These recommendations form an international reporting framework structured into four pillars: Governance, Strategy, Risk Management and Metrics & Targets.

Climate challenges: issues overseen at the highest levels of the company

Given their importance, climate related issues are overseen by BNP Paribas' highest management bodies: the Board of Directors and the Group's General Management. The Group’s Director and Chief Executive, Jean-Laurent Bonnafé, also involves himself personally. Throughout 2020, the Board of Directors and its specialised committees directly addressed climate issues ten times.

A strategy for the climate has been integrated into all of the Group's processes and activities, both through the involvement of management, business lines and several support departments, such as the Company Engagement Department, the Corporate Social Responsibility Function and the Risk Function.

Placing climate issues at the heart of strategy

The direct and indirect consequences of climate change for BNP Paribas are significant. In 2018, the Group has the ambition to align its activities with the objectives of the Paris Agreement and has taken the associated risks and opportunities into account in its strategy since then. In 2021, BNP Paribas reinforced this objective by joining the Net Zero Banking Alliance launched by the UN Environment Programme Finance initiative (UNEP FI). BNP Paribas is committed to aligning the greenhouse gas emissions arising from its credit and investment for own account activities with the required path toward financing a carbon neutral world in 2050.

These risks and opportunities are also taken into account within each of its business lines: Corporate and Investment Banking, Retail Banking and Specialised Business Lines, Asset Management and Insurance.

The Group’s approach of continuous improvement, its diversified and integrated model, and its commitments to carbon neutrality are key to the resilience of BNP Paribas to different possible climate scenarios.

Climate risk identification, assessment and management

Management of climate related risks is integrated into BNP Paribas' risk management framework. Two categories of risk stand out:

- Transition risks related to changes in the business environment due to climate change;

- Physical risks, which are the direct consequences of climate change on activity, such as extreme weather events or rising temperatures.

Climate related risk factors have notably been taken into account in the risk identification process, in risk anticipation exercises, in the assessment of country and sovereign risks and in scenario-based analysis systems. To that end, in 2021, BNP Paribas took part in a pilot exercise conducted by the Banque de France and the French banking and insurance supervisory body, the ACPR, which concluded that the exposure of French banks and insurance companies to climate risks is currently ‘moderate’.

Setting quantitative metrics and targets for BNP Paribas

The integration of climate related issues into BNP Paribas' activities is based on the definition and implementation of monitoring and steering indicators as well as the choice of quantitative targets. In particular, BNP Paribas uses the PACTA* methodology to measure the alignment of its credit portfolio with carbon neutrality scenarios. This methodology takes into account transition strategies of the Group’s clients to anticipate the evolution of their activities and compare it with recognised climate scenarios aligned with the objectives of the Paris Agreement, notably those of the International Energy Agency (IEA) .

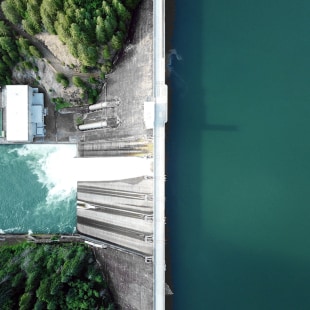

BNP Paribas also measures its contribution to the fight against climate change: In 2020, €17.8 bn was devoted to financing renewable energies; €4.5 bn of Sustainability Linked Loans** with a greenhouse gas emission reduction criterion were directly underwritten by the bank; and a total of €10.8 bn of green bonds were structured and placed. In terms of asset management, green funds managed by BNP Paribas Asset Management totaled €18.4 bn, green investments by BNP Paribas Cardif totaled €8.1 bn, and green funds managed by BNP Paribas Wealth Management totaled €6.7 bn.

Lastly, BNP Paribas measures its direct footprint, with operating emissions amounting to 1.80 tons of CO2 equivalent per full time equivalent (teqCO2/FTE), down 23% compared to 2019 and more than 40% compared to 2012.

The TCFD report, a milestone in a continuously evolving process

As a European leader in banking and financial services, BNP Paribas has taken an active place in the collective response to the challenges of climate change for over 10 years. Writing this TCFD report is an integral part of that process as BNP Paribas is convinced that transparency is essential for coordinated actions by all actors, companies, public authorities and citizens.

Ahead of the Glasgow Conference on Climate Change (COP26) scheduled for November 2021, this report is intended as a milestone for a continuously evolving approach. Highly mobilised, but also very conscious of the challenges at stake, BNP Paribas remains humble and lucid regarding the scale of the task at hand, which must be achieved collectively.

Click here to read the TCFD Report

*Paris Agreement Capital Transition Assessment

**Loans that have a rate which is in function of the achievement of environmental and/or social objectives by the borrower

***Direct emissions (scope 1), indirect emissions related to energy purhcases (Scope 2) and indirect emissions related to professional travel.