Sustainability indices

BNP Paribas is thus listed in the Dow Jones Sustainability Indices* World and Europe.

In 2020, only 25 banks out of 199 assessed were selected in the World index, and only 10 out of 34 in the Europe index.

Major improvements from year-to-year concern the areas “Human capital development” (+25 points), “Information security & Cybersecurity” (+17 points), “Labor practices” (+15 points), and “Risk & Crisis management” (+8 points). The Group policies in the fields of tax, corporate governance, business codes of conduct, and the promotion of the respect of human rights, were been awarded better grades in 2020.

Major improvements for the Group between 2019 et 2020

Human capital development

Information security & cybersecurity

Risk & crisis management

This year, BNP Paribas confirms its leadership in the Environment and Social dimensions of the assessment, where it positions itself respectively in the top 2% and the top 4% of banks assessed.

With scores of 100/100, the Group has particularly well performed in areas like “Materiality” (a strategy that is aligned with sustainability issues deemed most material for its activities and stakeholders), “Environmental reporting” and “Social reporting”, “Climate strategy” and “Financial inclusion”.

*Created jointly by S&P Dow Jones Indices and SAM, the Dow Jones Sustainability Indices (DJSI) are a family of best-in-class benchmarks for investors willing to reflect sustainability considerations within their investment portfolios.

SAM & BNP Paribas

Founded in 1999 by the Swiss asset manager Robeco (formerly RobecoSAM) and purchased in November 2020 by the American credit rating agency S&P Global, the SAM rating covers 7,300 companies from all sectors, considered as the most advanced worldwide in the sustainability domain. The rating relies on a detailed extra-financial questionnaire: the Corporate Sustainability Assessment (CSA). Depending on scores attributed based on an annual rating, eligible issuers are then listed or not within the Dow Jones Sustainability Indices.

Since 2002, BNP Paribas participates in this prestigious rating through performing its CSA evaluation. Structured in three domains, this questionnaire assesses activities and policies in the fields of economic responsibility (corporate governance, protection of clients’ interests, business ethics…), environmental responsibility (climate reporting, management of climate-related risks…), and social responsibility (health and safety, talent attraction, philanthropy…) dimensions. The SAM rating always relies on a questionnaire specific to the companies' industry.

“BNP Paribas participates in the SAM rating since 2002. Over time, it has become a strong indicator of our progress towards sustainability and our ability to tackle current and emerging challenges in this field. I am very proud to announce that again this year, BNP Paribas maintains itself in the Dow Jones Sustainability Indices, World and Europe. The Group performs very strongly this year, with an overall score exceeding 80%, positioning itself in the top 7% of over 250 banks assessed. These excellent results reflect our continuous commitment to integrate environmental, social and governance considerations within our activities. In the context of a sanitary crisis, we are more than ever convinced that a responsible and sustainable economy is key to protect the interests of our clients."

Laurence Pessez, Global Head of Corporate Social Responsibility of BNP Paribas

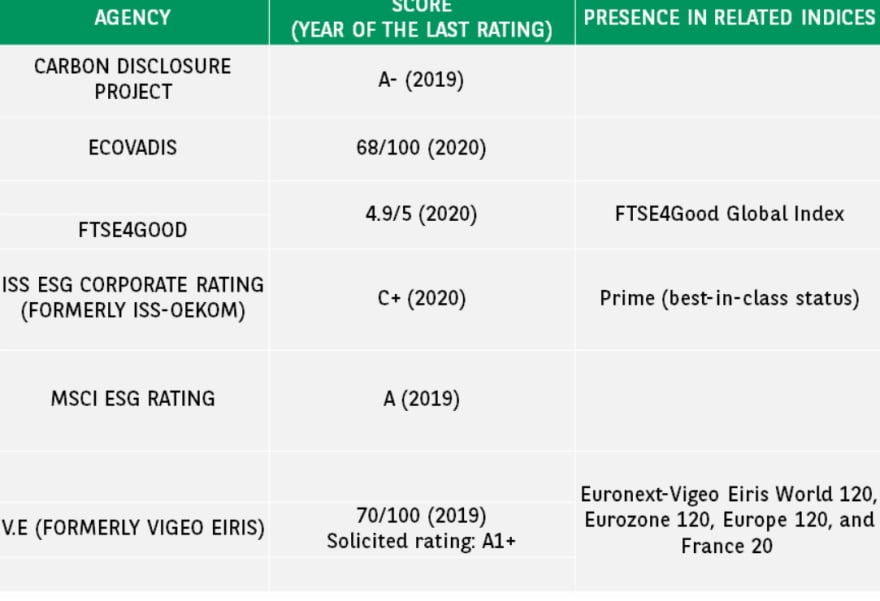

Extra-financial ratings

‘Extra-financial’ analysis consists in assessing companies, sovereign states and other kinds of issuers of financial securities on their environmental, social and governance (ESG) policies. Based on this analysis, the agency then draws up a rating that enables a comparison to be made between different issuers – whether or not they are listed companies – on their ESG practices.

- BNP Paribas was designated World's Best Bank for Financial inclusion in Euromoney’s Awards for Excellence 2020, a reference publication in international finance;

- BNP Paribas was also named “Investment Bank of the Year for Sustainable FIG financing”, “Investment Bank of the Year for Sustainability-linked Loans” and “Investment Bank of the Year for Social Bonds” by the magazine The Banker, a Financial Times’ publication;

- BNP Paribas is the first French bank and third bank worldwide in the “Global 100 Most Sustainable Corporations” ranking published by the Canadian sustainability magazine Corporate Knights;

- In 2020, BNP Paribas’ shares are currently listed in Bloomberg Gender-Equality Index.